Market Demand for Recycled Steel: Steel Recycling’s Outlook

Over 1,085 million tons of steel are recycled worldwide annually to help meet the high demand for this excellent building material.

As more people become aware of the importance of sustainable construction, the market demand for recycled steel is expected to continue growing. Countries like China, the E.U., and the U.S. have experienced a surge in steel recycling, making recycled steel an obvious choice for new projects.

According to The Bureau of International Recycling (BIR), steel scrap usage in 2021 increased compared to the previous year, based on its figures, which it estimates cover 79.7 percent of global steel production.

The trend goes back several years and shows a significant increase in steel scrap used to produce recycled steel between 2017 and 2021. This has been largely driven by China, which produced more than half the world’s crude steel during that period and increased its scrap steel usage from 147.9 million tonnes in 2017 to 226.21 million tonnes in 2021.

This data confirms that the market demand for recycled steel is on an upward trajectory as more people incorporate the material into their green building projects.

In this article, I’ll discuss the market demand for recycled steel and why the trend is on an upward trajectory. I’ll discuss the leading countries in recycled steel production and consumption, including the sectors accounting for the most usage. Keep reading to find out more!

Steel Consumption and Demand

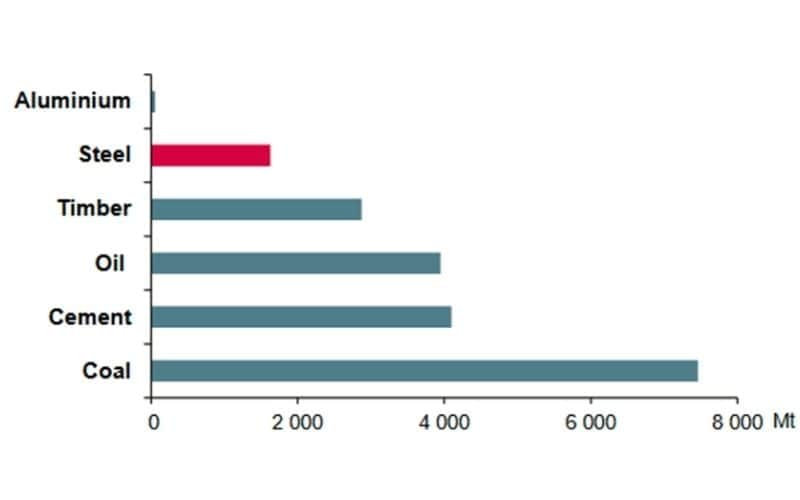

Steel production and consumption have remained on an upward trajectory since the 1950s. This is because steel is the most used product globally, after coal, cement, oil, and timber.

The chart below compares steel production with other commodities:

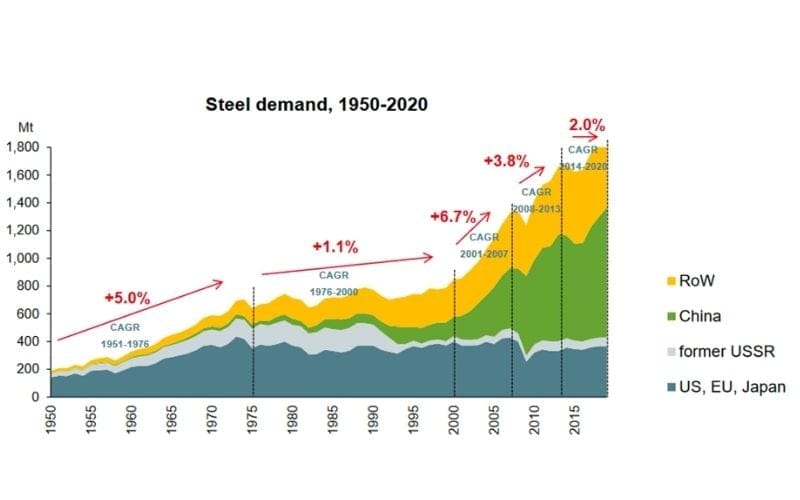

China has been the main driving force behind the growth in steel consumption and demand for recycled steel due to the growth in their construction and automobile sectors.

There has also been significant growth in countries represented in the statistics under the “rest of the world” (RoW) category, and this growth is expected to continue, or even strengthen.

These RoW countries include:

- Argentina

- Canada

- South Africa

- Russia

- India

- Mexico

- Turkey

- Switzerland

In 2020, the most recent year reported by the Global Forum on Steel Excess Capacity (GFSEC), China comes second after RoW countries on demand for finished steel, ahead of the rest of developing Asia (excluding China), the European Union and NAFTA (the North American Free Trade Agreement, representing the United States, Canda and Mexico).

This is perhaps unsurprising, considering China has over ten times the U.S.’s steelmaking capacity.

The chart below summarizes steel consumption and demand from 1950 to 2020:

Application of Recycled Steel in Construction

Construction is among the main sectors accounting for high recycled steel usage. In addition, structural steel, like columns and beams, can be reused without remelting and reprocessing – so called salvaged steel.

Recycled steel is a more eco-friendly material than crude, or virgin, steel and is ideal for different construction projects because it is cheaper than crude steel and keeps its strength and durability no matter how many times it is melted down and recycled. This explains why the consumption rate of recycled steel in construction is high.

Recycled steel is used in the following ways in construction:

- Structural components: Making steel columns, girders, and beams because of their excellent tensile and yield strength.

- Reinforcement bars (rebar): Due to its excellent strength and durability, recycled steel is used to make rebar to strengthen concrete. Besides buildings, rebar is ideal for bridges, highways, and tunnel construction.

- Roofing materials: Making corrugated metal sheets, standing seam roofs, and metal shingles due to the material’s lightweight nature and durability.

- Connectors and fasteners: Making nails, screws, bolts, and other fasteners used in construction.

- Prefabrication building: Making prefabricated components like frames for easier and speedier construction.

- Cladding and siding: Producing steel sheets for building cladding and siding.

Steel Production and Consumption Statistics

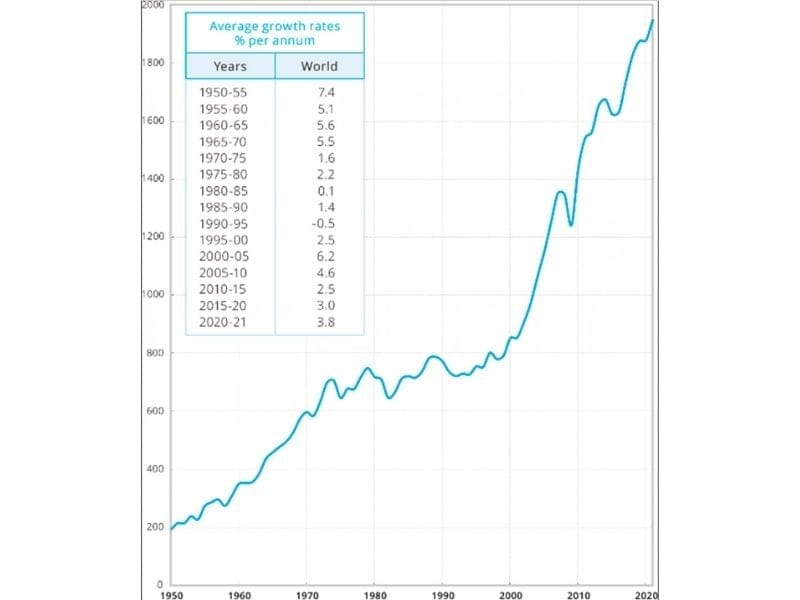

Steelmaking is one of the industries that has experienced tremendous growth in the past five decades.

Since the 1950s, steel supply has been crucial for the growth and expansion of cities, urban infrastructure, and automobiles.

Only 189 million metric tons of crude steel were manufactured in 1950. However, the production rate kept increasing to meet the growing demand.

In 2021, global steel production was 1,951 million metric tons and is expected to keep increasing to meet the rising demand.

Here is a chart summarizing the average growth rates in steel production from 1950 to 2020:

As of 2021, China, India, Japan, the United States, and Russia were the top five steel-producing countries.

The high steel production rate in these countries is driven partly by their high consumption rates, especially in the construction and automobile sectors.

For instance, China produced 1.01 billion tons of steel in 2022, the highest figure globally. This is due to the country’s rapid modernization of its economy, infrastructure, construction, and manufacturing industries.

Here is a table summarizing the world’s largest steel producers in 2020 and 2021 in million tons:

| Country | 2021 | 2020 | ||

| Rank | Tonnage | Rank | Tonnage | |

| China | 1 | 1,032.8 | 1 | 1,064.7 |

| India | 2 | 118.2 | 2 | 100.3 |

| Japan | 3 | 96.3 | 3 | 83.2 |

| United States | 4 | 85.8 | 4 | 72.7 |

| Russia | 5 | 75.6 | 5 | 71.6 |

| South Korea | 6 | 70.4 | 6 | 67.1 |

| Turkey | 7 | 40.4 | 7 | 35.8 |

| Germany | 8 | 40.1 | 8 | 35.7 |

| Brazil | 9 | 36.2 | 9 | 31.4 |

| Iran | 10 | 28.5 | 10 | 29.0 |

Table 1: Top 10 steel-producing countries in 2020 and 2021. Source: World Steel Association

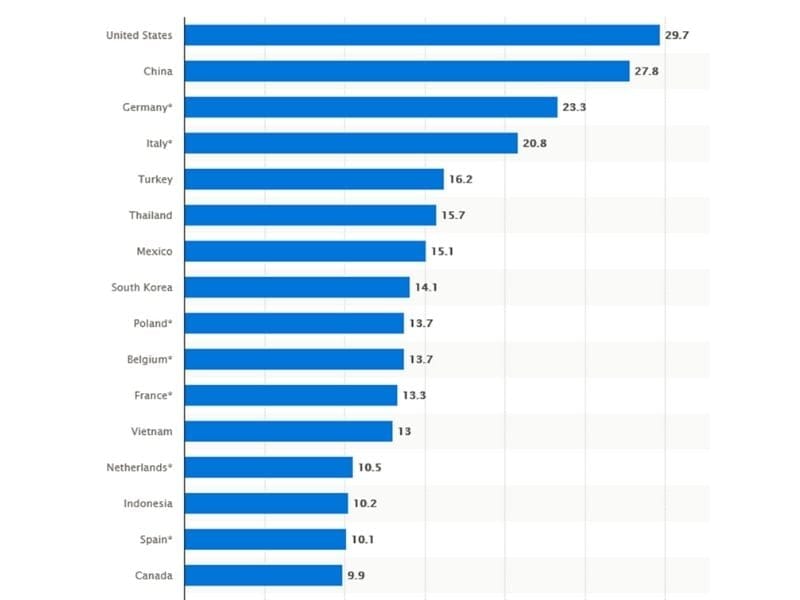

The U.S. was the leading importer of steel in 2021 after importing 29.7 million tons. It was followed closely by China, Germany, Italy, and Turkey, as shown in the chart below:

Steel Industry Trends and Forecasts

In 2023, the world’s steel scrap market was estimated at 655 million metric tons. It’s forecasted to rise by a steady Compound Annual Growth Rate (CAGR) of 4.9 percent to 1,050 million metric tons from 2023 to 2033.

The demand for recycled steel is forecasted to increase over the coming years due to the high demand for steelmaking raw materials. Growing economies like Brazil, China, and India play a significant role in the high demand for steelmaking raw materials. As demand increases for these raw materials, steel scrap helps make up the deficit.

It’s also true that many countries are prioritizing recycled steel to minimize their carbon footprints, contributing further to its anticipated market growth.

Countries like India are promoting sustainable building materials like recycled steel to combat climate change. For instance, in 2019, India’s Ministry of Steel released a steel scrap recycling policy outlining the essential practices for eco-conscious steel recycling.

The table below summarizes the steel scrap market valuation and the forecasted growth trend to 2033:

| Attribute | Details |

| Size of the market in 2022 | 624.5 million metric tons |

| Market value in 2023 | 655 million metric tons |

| Forecasted market value by 2033 | 1,050 million metric tons |

| Compound Annual Growth Rate | 4.9% |

| Obsolete steel scrap sector growth rate from 2023 to 2033 | 5.3% |

Table 2: Recycled steel market trajectory from 2023 to 2033. Source. Fact. MR

Factors Influencing Recycled Steel Demand

The high demand for primary steel results from its wide application in the construction, infrastructure, and automobile industries.

However, the demand for recycled steel is influenced by many other global factors, including:

- The need to reduce carbon dioxide emissions: Recycling a ton (2,000 lb) of steel prevents the emission of about 1.67 tons (3,340 lb) of carbon dioxide. Consequently, more countries are shifting towards recycled steel for its sustainability benefits, increasing the material’s demand.

- Need for quality metal to support virgin steel production: Basic Oxygen Furnace (BOF) and Electric Arc Furnace (EAF) steel production includes the use of steel scrap. Therefore, even companies that manufacture primary steel need scrap steel for efficient production.

- Cost-efficiency: Recycled steel is more cost-effective than its virgin counterpart. This is because its production doesn’t involve the energy-intensive processes like mining and smelting of iron ore that consume more power and natural resources. Consequently, the demand for secondary steel increases as more people turn to it to save costs.

- Energy conservation: Primary steel production is energy-intensive and consumes more natural resources. As a result, countries are shifting to recycled steel to conserve their energy resources, increasing demand.

Steel Usage in Infrastructure Development

Steel is the backbone of essential infrastructural development. It’s used in most large-scale infrastructure projects because of its strength, ductility, durability, efficiency, and adaptability.

Over 60 percent of steel use in transport infrastructure projects is as reinforcement rebar. The rest is as plates and rail tracks.

In terms of utility infrastructure like water, fuel, and power, over 50 percent of steel use is in underground water and gas distribution pipelines. The rest goes into reinforcement rebar for pumping houses and power stations.

Here are the main steel applications in infrastructure development:

- Tunnels: Building underground, underwater, and under-city tunnels.

- Bridges: Plates, framing, and water-resistant bolts and fasteners.

- Elevated walkways: Pedestrian walkways and load-bearing steel grates.

- Utility pipelines: Pipelines for oil, gas, water, and power supply.

Global Steel Demand By Sector

Construction, machinery, transport, and electrical sectors rely on steel for operation. However, the demand for steel in these sectors varies — some have higher demand for steel products.

The construction sector has the highest demand for steel. It accounts for about 50 percent of the world’s steel consumption.

The construction industry relies heavily on steel for the following reasons:

- Strength and durability: Steel is a strong and durable material ideal for structural building components.

- High versatility: It’s easy to work with steel due to its high versatility. Builders can shape and form it to meet their construction requirements.

- Lightweight: Steel is lighter than equivalent timber beams — it’s easy to move from one place to another when building. Moreover, it reduces the dead load on the foundation and structure.

Due to its high demand for steel products, the construction industry accounts for USD 7.5 trillion of the steel market.

The U.S. and China’s construction industries are the main consumers of steel products. The high demand for steel in China is due to infrastructure expansion and other non-residential projects.

Besides construction, other sectors that drive steel demand are:

- Transport: 16%.

- Metal products: 14%.

- Machinery: 14%.

- Domestic appliances: 3%.

- Electrical equipment: 3%.

Final Thoughts On Market Demand for Recycled Steel

The growing market demand for recycled steel points to a brighter future for the industry.

The steel industry has minimized natural resource depletion and climate change through greater production of recycled steel which is less energy-intensive to produce and uses less natural resources like iron ore and coal.

China, India, and the U.S. have the highest steel consumption rates due to their massive construction sectors.

It’s expected that the demand for recycled steel will keep increasing as more countries embrace the material for its cost and sustainability benefits.